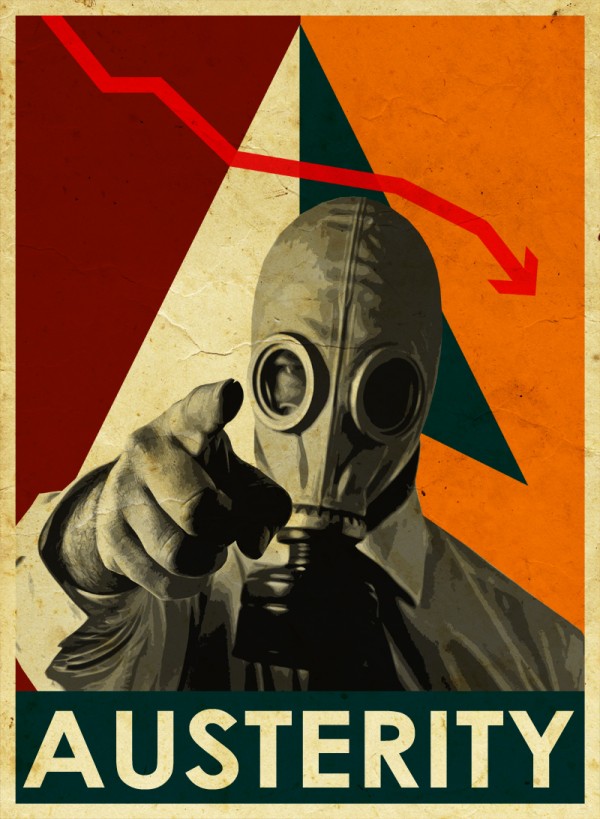

HUFFINGTON POST: The debunking of Carmen Reinhart and Kenneth Rogoff continues. The Harvard economists have argued that mistakes and omissions in their influential research on debt and economic growth don’t change their ultimate austerity-justifying conclusion: That too much debt hurts growth. But even this claim has now been disproved by two new studies, which suggest the opposite might in fact be true: Slow growth leads to higher debt, not the other way around. In a post at Quartz, University of Michigan economics professor Miles Kimball and University of Michigan undergraduate student Yichuan Wang write that they have crunched Reinhart and Rogoff’s data and found “not even a shred of evidence” that high debt levels lead to slower economic growth. And a new paper by University of Massachusetts professor Arindrajit Dube finds evidence that Reinhart and  Rogoff had the relationship between growth and debt backwards: Slow growth appears to cause higher debt, if anything. MORE

Rogoff had the relationship between growth and debt backwards: Slow growth appears to cause higher debt, if anything. MORE

FINANCIAL TIMES: i Harvard economists Carmen Reinhart and Kenneth Rogoff have published an errata to their 2010 paper on public debt and growth, acknowledging more errors in the figures, but leaving their basic conclusion unchanged. The release of the formal correction is the latest move in an academic spat with unusually weighty consequences for public policy. The original paper was widely cited as an argument for fiscal austerity in 2010 and the fight over their figures has become a proxy for broader battles about deficits. In the errata, the pair correct the mean averages for growth from 1946 to 2009 that were originally criticised by Robert Pollin and his co-authors at the University of Massachusetts, Amherst. But they also correct medians for the 1946-2009 data as well as means and medians for another set of data that goes back to 1800. The row has shown the need for replication to check academic work as well as the difficulty of drawing strong conclusions from small samples of economic data. But the corrections do not affect Mr Rogoff and Ms Reinhart’s most up-to-date work, which still shows a slowdown in growth when debt hits 90 per cent of gross domestic product.

Scholarly arguments can be savage but they are usually slow. The battle between R&R and HAP – as the critics are known for the initials of their last names – has been high speed, high adrenalin and fought out in public. The  row began in April when a student, Thomas Herndon, tried and failed to replicate the famous R&R paper as a piece of coursework. It turned out that the averages in R&R were wrong – in part because of an error with an Excel spreadsheet. The R&R duo acknowledged the error, but in a response published in the New York Times, they said that they had always relied on their median figures. “We have never used anything but the conservative median estimate in our public discussions,” wrote R&R, “where we stated that the difference between growth associated with debt under 90 per cent of GDP and debt over 90 per cent of GDP is about 1 percentage point.” In response, the HAP authors wrote a new criticism pointing out that the median figures were also affected by the same error. “Their defence made all the same mistakes that they made in their original paper,” Mr Pollin said. MORE

row began in April when a student, Thomas Herndon, tried and failed to replicate the famous R&R paper as a piece of coursework. It turned out that the averages in R&R were wrong – in part because of an error with an Excel spreadsheet. The R&R duo acknowledged the error, but in a response published in the New York Times, they said that they had always relied on their median figures. “We have never used anything but the conservative median estimate in our public discussions,” wrote R&R, “where we stated that the difference between growth associated with debt under 90 per cent of GDP and debt over 90 per cent of GDP is about 1 percentage point.” In response, the HAP authors wrote a new criticism pointing out that the median figures were also affected by the same error. “Their defence made all the same mistakes that they made in their original paper,” Mr Pollin said. MORE

HUFFINGTON POST: “This is a mistake that has had enormous consequences,” wrote Dean Baker of the Center for Economic and Policy Research. “If facts mattered in economic policy debates, this should be the cause for a major reassessment of the deficit reduction policies being pursued in the United States and elsewhere.” MORE

THE GUARDIAN: “Many politicians in favour of austerity have quoted their work in recent years to justify their positions,” said Valentijn van Nieuwenhuijzen, the head of strategy at ING Investment Management. “With  that support now almost eliminated and the fairytale of expansionary austerity [on the back of magically improved confidence] being completely contradicted by the facts on the ground over the last three years, the ability of those remaining austerians to ‘sell’ their story to the public has been seriously damaged.” Jonathan Portes, the director of the National Institute for Economic and Social Research, said: “Clearly the balance of argument in academic circles has shifted somewhat. That’s partly as a result of Reinhart-Rogoff but also as a result of seeing the facts on the ground. The continued depression in parts of the eurozone means that people think austerity on its own is a doomed strategy.” That is certainly the view of the International Monetary Fund, which has produced research showing that the impact of austerity is greater when countries have limited scope to offset the impact of tighter fiscal policy by cutting interest rates, and when a large number of countries are cutting back at the same time. MORE

that support now almost eliminated and the fairytale of expansionary austerity [on the back of magically improved confidence] being completely contradicted by the facts on the ground over the last three years, the ability of those remaining austerians to ‘sell’ their story to the public has been seriously damaged.” Jonathan Portes, the director of the National Institute for Economic and Social Research, said: “Clearly the balance of argument in academic circles has shifted somewhat. That’s partly as a result of Reinhart-Rogoff but also as a result of seeing the facts on the ground. The continued depression in parts of the eurozone means that people think austerity on its own is a doomed strategy.” That is certainly the view of the International Monetary Fund, which has produced research showing that the impact of austerity is greater when countries have limited scope to offset the impact of tighter fiscal policy by cutting interest rates, and when a large number of countries are cutting back at the same time. MORE